Did you know that an invisible, odorless gas could be affecting your home insurance rates? Radon, a naturally occurring radioactive gas, is a silent threat that many homeowners overlook. While most people know about its health risks, few realize its potential impact on home insurance. What do insurance companies avoid telling you about radon? And how does it affect your policy? Let’s dive into the details and uncover the truth.

What is Radon and Why Should You Care?

Radon is a naturally occurring radioactive gas that comes from the breakdown of uranium in soil, rock, and water. Since it’s invisible and odorless, it can easily seep into homes unnoticed. The real problem? Long-term exposure can lead to serious health issues, especially lung cancer.

How Does Radon Get into Your Home?

Radon enters homes through cracks in floors, walls, and foundations. It can also come in through well water or be trapped in building materials. Think of radon like an uninvited guest that sneaks in through every tiny gap in your home’s foundation.

The Health Risks of Radon Exposure

Radon is the second leading cause of lung cancer in the U.S., right after smoking. The Environmental Protection Agency (EPA) states that radon exposure is responsible for about 21,000 lung cancer deaths per year. The risk is even higher for smokers. If you think radon isn’t a big deal, consider this: Would you willingly inhale cigarette smoke every day? Probably not. But if your home has high radon levels, you might be exposing yourself to similar risks.

Does Home Insurance Cover Radon Mitigation?

Most home insurance policies do not cover radon testing or mitigation. This means if you discover high radon levels in your home, you’ll have to pay for the mitigation yourself. Why? Because insurance companies consider it a “preventable issue”—like termites or mold. They expect homeowners to handle it before it becomes a problem.

How Radon Affects Your Home’s Value

Homes with high radon levels can be harder to sell. Buyers may demand radon testing and insist on mitigation before closing a deal. If your home has been flagged for high radon, you might face price reductions or even struggle to find a buyer at all.

Why Insurance Companies Are Silent on Radon

Insurance providers tend to downplay radon risks because acknowledging them could lead to liability concerns. If they admitted radon was a serious problem, more homeowners would file claims or demand coverage—something insurers want to avoid. From their perspective, radon mitigation falls under home maintenance responsibilities, much like pest control or roof repairs. By labeling it as a preventable issue, they shift the financial burden onto homeowners.

Another reason for their silence is the lack of federal regulations requiring insurance companies to disclose radon-related risks. Unlike hurricanes or floods, radon exposure isn’t classified as an “immediate catastrophic event.” Since its effects develop over time, insurers argue that homeowners should take proactive steps to test and mitigate, rather than expecting a policy to cover it.

Additionally, admitting that radon is a widespread problem could open the floodgates for legal claims and lawsuits. If an insurer acknowledges radon risks but still denies coverage, homeowners might challenge them in court. To avoid this potential legal headache, many insurers choose to remain silent and simply exclude radon from their policies.

In some cases, insurers will adjust premiums or deny coverage altogether if a home has high radon levels. This can make it difficult for homeowners to obtain or renew policies, especially in high-risk regions. However, they rarely advertise this practice, leaving homeowners unaware until they attempt to buy or renew a policy.

Ultimately, radon is an inconvenient topic for insurance companies—one they prefer not to address. Homeowners, however, cannot afford to ignore it. The best way to protect yourself is to test regularly, invest in mitigation if needed, and stay informed about state regulations and insurance options.

Radon Testing: A Homeowner’s Responsibility

Since insurance doesn’t cover it, radon testing falls on homeowners. The EPA recommends testing homes at least every two years, especially if you live in high-risk areas. DIY radon test kits are available, but professional testing is more reliable.

Does Radon Affect Home Loan Approvals?

Yes, radon can impact mortgage approvals. Some lenders require radon tests before approving loans, especially for FHA and VA loans. If high radon levels are detected, mitigation might be a condition for loan approval.

State and Federal Laws on Radon

While the federal government doesn’t mandate radon mitigation, many states have regulations. Some require radon disclosures during home sales, while others offer assistance programs for mitigation.

How to Reduce Radon Levels in Your Home

Reducing radon is possible with the right steps:

- Install a radon mitigation system: These systems use ventilation to redirect radon gas outside.

- Seal foundation cracks: This prevents radon from seeping in.

- Improve home ventilation: Increased airflow can help dilute radon concentration.

Radon and Real Estate Transactions

If you’re buying or selling a home, radon can be a deal-breaker. Buyers often request radon tests, and sellers may need to lower their price or pay for mitigation if high levels are found.

How to Negotiate Insurance Policies with Radon

While standard policies don’t cover radon, some companies offer endorsements—additional coverage for specific risks. When shopping for home insurance, ask about radon-related coverage options.

The Hidden Costs of Radon in Homes

- Beyond health risks, radon can lead to:

- Expensive mitigation costs ($1,000–$7,500)

- Reduced home resale value

- Higher home inspection costs

What Homeowners Can Do to Stay Protected

- Test your home regularly

- Install a mitigation system if needed

- Ask your insurer about radon-related policies

- Stay informed about radon laws in your state

Final Thoughts and Takeaways

Radon is a hidden risk that many homeowners ignore—until it becomes a major issue. While home insurance companies don’t typically cover radon mitigation, being proactive can protect your health, home value, and financial security. Test your home, stay informed, and don’t let this silent threat go unnoticed.

FAQs

Q: Does homeowners insurance cover radon mitigation?

A: No, most homeowners insurance policies do not cover radon testing or mitigation. Homeowners must pay for these services themselves.

Q: How can I test my home for radon?

A: You can use a DIY radon test kit or hire a professional radon testing service for more accurate results.

Q: Can high radon levels impact my home’s resale value?

A: Yes, homes with high radon levels can be harder to sell, and buyers may negotiate lower prices or require mitigation before purchase.

Q: How much does radon mitigation cost?

A: Radon mitigation typically costs between $1,000 and $7,500, depending on your home’s structure and the severity of the problem.

Q: Should I worry about radon if my home is new?

A: Yes, radon can affect new homes just as much as older ones. In fact, energy-efficient homes may trap radon inside, increasing the risk.

By staying informed and taking proactive steps, homeowners can protect their families and ensure their insurance policies provide the right coverage where possible.

Don’t Wait – Get Your Home Tested for Radon

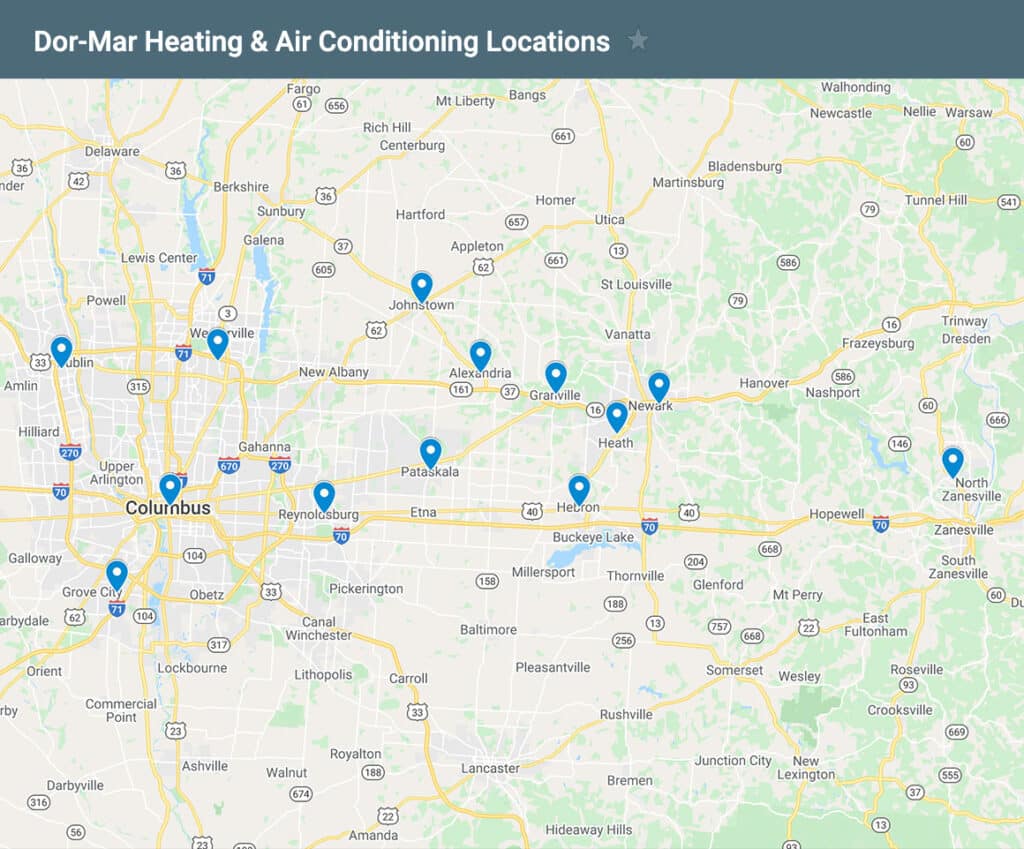

If you are not sure if your home has issues with radon gas, it’s best to get it tested. And it’s easy as a quick phone call Dor-Mar Radon Testing & Mitigation at (740) 675-1103 to arrange for a radon test. Or you can use the convenient form on our Radon Testing page.